I know that the subject of Mitt Romney’s claim that 47% of Americans are “dependent upon government”, believe that they are “victims”, and won’t “take personal responsibility and care for their lives” is probably being beaten to death in the media today. As it should be. But knowing that much of the media either can’t or won’t delve terribly deeply into the issues (or will instead focus on false equivalencies), I want to take some time to talk about Romney’s statement.

First, here’s a transcript of the pertinent part:

There are 47% of the people who will vote for the president no matter what. All right, there are 47% who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that's an entitlement. And the government should give it to them. And they will vote for this president no matter what....

He starts off with a huge number. These are people who pay no income tax. Forty-seven percent of Americans pay no income tax. So our message of low taxes doesn't connect. So he'll be out there talking about tax cuts for the rich. I mean, that's what they sell every four years. And so my job is not to worry about those people. I'll never convince them that they should take personal responsibility and care for their lives.

Obviously, the 47% Romney is talking about are the 47% of Americans who don’t pay any federal income tax. But, as I discussed over a year ago when this Republican talking point began gaining traction (see my post Do Republicans Want to Raise Taxes on the Poor and Elderly?), that number represents only federal income taxes. It excludes state income taxes, property taxes, sales taxes, and excise taxes. And most importantly, it also excludes payroll taxes (which, by the way, people like Mitt Romney don’t pay). And, as I noted in that post:

We also need to consider who is not paying federal income taxes and why. By and large, the people who aren’t paying federal income taxes aren’t paying federal income taxes because they don’t have much income. The poor don’t have much in the first place, the unemployed aren’t earning an income, and many elderly are living on their retirement and social security and also have little income. So, perhaps getting upset that a majority of Americans don’t pay federal income taxes is the wrong concern. Shouldn’t we, instead, be more concerned with the fact that a majority of Americans earn so little that they are eligible for enough credits to wipe out their tax liabilities?

When you exclude the elderly, the working poor, students, and the unemployed who are trying unsuccessfully to look for work, that 47% becomes smaller and smaller and smaller. To help illustrate the point, take a look at this graph from Misconceptions and Realities About Who Pays Taxes by the Center for Budget and Policy Priorities that I previously posted in A Chart Is Worth a Thousand Words):

In fact, the article Misconceptions and Realities About Who Pays Taxes (which was updated yesterday) is worth reading.

And, as I asked last August:

When you hear a Republican tell you that a majority of Americans don’t pay federal income taxes (presuming that they get that statement right in the first place), what they’re really saying is that we need to do one of two things: (a) Remove credits and deductions that allow people to “escape” paying taxes; and/or (b) increase the amount of taxes that those at the lowest income brackets pay. Because only by doing one (or both) of those things do we make the system more “fair” and have more people actually pay federal income taxes. Is that really what Republicans are advocating? At the same time that they are refusing to close loopholes that allow billionaires like Warren Buffet [to] pay lower effective tax rates than their employees (because most of their income is non-payroll and only taxed at the lower capital gains tax rate), do Republicans really want to increase income taxes on the working poor, unemployed, and elderly? Because that’s sure what it sounds like, even if they don’t quite realize that’s what they’re saying.

And didn’t virtually all of the Republicans in Congress (and Mitt Romney, too, if I’m not mistaken) sign a pledge not to raise any taxes?

The other part of Romney’s claim that is worth noting is his notion that this 47% of the population views itself as “victims”. Do the elderly view themselves as victims? What about students? This morning I even saw a post on Twitter (which I have not endeavored to check the math on) that suggests that a 6-year Army Staff Sergeant with a stay-at-home wife and two children would pay no federal income taxes (his salary being approximately $34,636). Do you think he views himself as a victim?

The odd (and unfortunate thing) here is that a not inconsiderable portion of those who do receive federal funds (in the form of Social Security, Medicare, veterans benefits, and other programs) don’t actually understand or recognize that they are the beneficiaries of federal programs.

Romney also takes issue with the notion that some Americans feel entitled to healthcare, food, and housing. You know, the basics. The disdain that Romney shows to that idea really lays bare his vision of America, where a single mother living and working in poverty shouldn’t necessarily expect a roof over her head or food or medicine for her children. If she doesn’t make enough, tough shit. Because, you know, if she would “take personal responsibility and care” for her life, she wouldn’t need that government assistance. Perhaps if she’d just borrowed $20,000 from her parents to afford college or to start a business, she wouldn’t be living in squalor. Of course, Romney doesn’t seem to have a problem with tax deductions for corporate jets or dancing horses (with cute little hats). After all, those are entitlements that we can all appreciate, right?

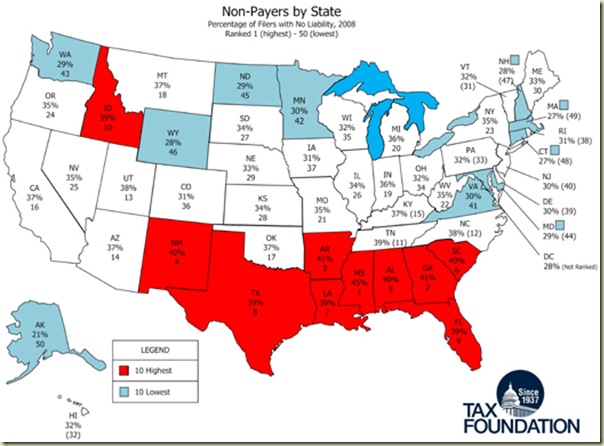

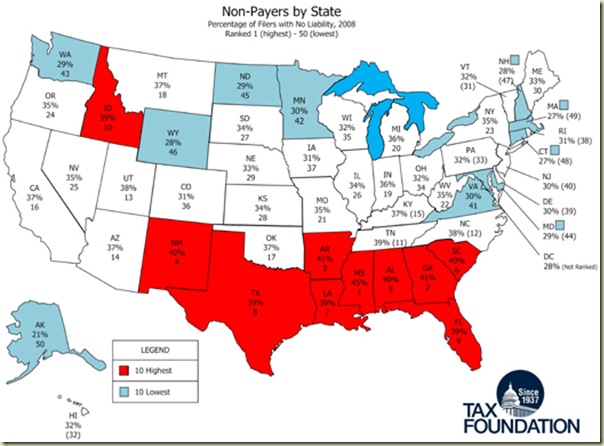

As to his notion that “they will vote for this president no matter what”, isn’t Romney really missing his target? I mean, the elderly make up a huge portion of that 47% but they have been one of the GOP’s strongest demographic supports. So, too, the military. In fact, as the Tax Foundation points out, eight of the 10 states with the highest percentage of households paying no federal income tax are traditional “red states” (the other two being New Mexico [leans Democratic] and Florida [a tossup]):

In other words, it seems that Romney is largely attacking his own base.

In other words, it seems that Romney is largely attacking his own base.

Moreover, what does it say about a candidate for President who says of nearly half the population:

[M]y job is not to worry about those people. I'll never convince them that they should take personal responsibility and care for their lives.

The utter disdain and scorn that Romney shows for nearly half of the population is an outrage. That he would focus that disdain and scorn upon those with the least is even worse. At least he recognizes that people whose income is so small that they don’t pay federal income taxes won’t necessarily respond favorably to a plan of tax cuts for the wealthy.

And I’m sure that you’ll hear the media go into false equivalence overdrive today, most likely focusing on then-candidate Barack Obama’s statement about those who “cling to guns or religion”. But there is an enormous, massive, gigantic difference between Obama’s statement in 2008 and Romney’s statement in 2012. Romney says that he’ll “never convince them” and that they’ll “vote for this president no matter what”. In other words, Romney is completely writing off that 47% of the electorate. Obama, on the other hand, was talking about how to engage and convince those voters and discussing why they feel let down by the system. In other words, Obama’s statement was the polar opposite of Romney’s.

Don’t believe me? Then take a few moments and read what Obama actually said that day and take the “guns and religion” comment in context. And as you read Obama’s comments, compare what he was saying then to what Romney is saying now.

So, it depends on where you are, but I think it's fair to say that the places where we are going to have to do the most work are the places where people feel most cynical about government. The people are mis-appre… I think they’re misunderstanding why the demographics in our, in this contest have broken out as they are. Because everybody just ascribes it to ‘white working-class don't wanna work — don't wanna vote for the black guy.’ That's… there were intimations of that in an article in the Sunday New York Times today — kind of implies that it's sort of a race thing. Here’s how it is: in a lot of these communities in big industrial states like Ohio and Pennsylvania, people have been beaten down so long, and they feel so betrayed by government, and when they hear a pitch that is premised on not being cynical about government, then a part of them just doesn’t buy it. And when it’s delivered by — it's true that when it’s delivered by a 46-year-old black man named Barack Obama (laugher), then that adds another layer of skepticism (laughter).

But — so the questions you’re most likely to get about me, ‘Well, what is this guy going to do for me? What’s the concrete thing?’ What they wanna hear is — so, we’ll give you talking points about what we’re proposing — close tax loopholes, roll back, you know, the tax cuts for the top 1 percent. Obama’s gonna give tax breaks to middle-class folks and we’re gonna provide health care for every American. So we’ll go down a series of talking points.

But the truth is, is that, our challenge is to get people persuaded that we can make progress when there’s not evidence of that in their daily lives. You go into some of these small towns in Pennsylvania, and like a lot of small towns in the Midwest, the jobs have been gone now for 25 years and nothing’s replaced them. And they fell through the Clinton administration, and the Bush administration, and each successive administration has said that somehow these communities are gonna regenerate and they have not. So it’s not surprising then that they get bitter, they cling to guns or religion or antipathy to people who aren’t like them or anti-immigrant sentiment or anti-trade sentiment as a way to explain their frustrations.

Um, now these are in some communities, you know. I think what you’ll find is, is that people of every background — there are gonna be a mix of people, you can go in the toughest neighborhoods, you know working-class lunch-pail folks, you’ll find Obama enthusiasts. And you can go into places where you think I’d be very strong and people will just be skeptical. The important thing is that you show up and you’re doing what you're doing.

(Emphasis added.)

I also think that it’s worth noting that Mitt Romney still refuses to release more than one year of his own tax returns. It would be nice to know, wouldn’t it, whether Romney is more like the 53% or the 47%? He’s already acknowledged that his tax rate is around 13% (and, unless I’m mistaken, he didn’t make clear whether that was federal or federal and state combined). And the year for which he’s released his taxes may have been an unusual year in that he received income for his book and speaking engagements and not solely capital gains. Don’t forget that an independent analysis showed that if the Paul Ryan (or Romney-Ryan) budget had been in place for 2010, Romney’s federal taxes would have been approximately 0.82% of his income. But I’m sure that Romney would exclude himself from that class of victims who feel dependant upon the government.

The idea that a candidate for president has simply written off nearly half of the population as moochers, as self-identified victims, as people who vote solely on the basis of their own desire for “more” from the government, and as essentially unreachable is, as I’ve suggested already, an outrage. It shows us that Romney doesn’t really want to be President of the United States of America; rather, he wants to be President of the wealthy part of the country and it’s just not his job to worry about the rest of the people.

Labels: Election, Politics